Forvia, a market paradox.

Rarely is it truly the end

Good morning, reader. Since the last publication, I have restructured the blog to make it easier to find content. Also, I realized that after more than a year, I hadn't filled out the "About us" section.

Sometimes, in the process of researching a company and its competitors, you find interesting ideas, and this is the case for the company we're discussing today. During Dowlais investigation, I discovered Forvia, the world's 7th largest auto supplier and the most penalized in the stock market at this point in the cycle. For a value investor, this is a call to investigation.

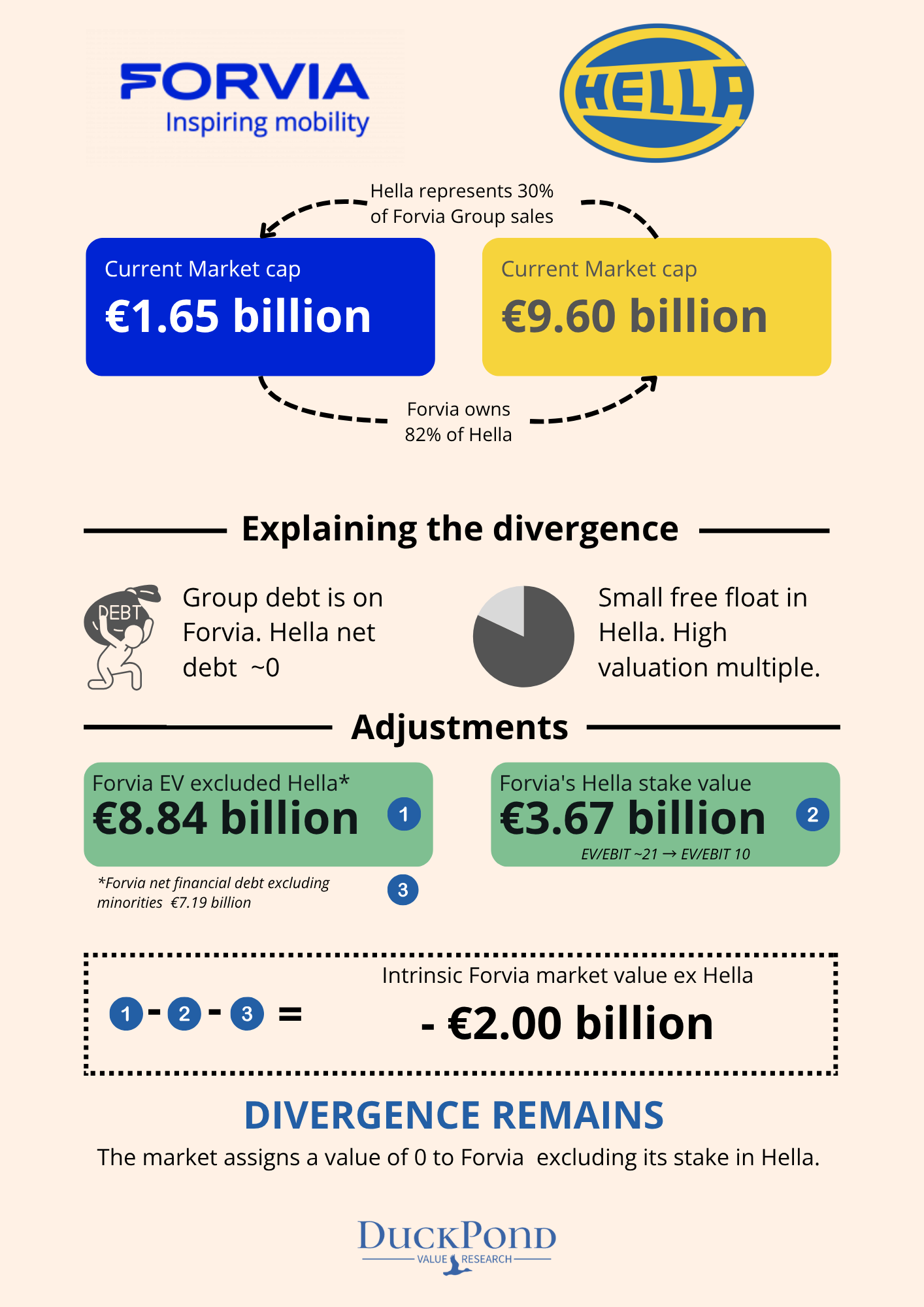

Here we encounter one of those contradictions that the market sometimes presents: Forvia owns 82% of a company that is worth more on the stock market than the group itself. A paradox that I summarize in the following infographic:

I will talk more about this at the end of the thesis, but the important thing is that the market is valuing the rest of Forvia at 0.

As always, with every punished company, the market's narrative holds some truth, although, at times, excessive pessimism drags prices into territory that offers a margin of safety for those willing to take a long-term view.

Rarely is it truly the end.

We will now address this historical French company, the reasons for current market negativity, and the factors that could transform it into a long-term investment opportunity. Let's dive deep into Forvia.

Forvia, formerly known as Faurecia, traces its origins to Bertrand Fauré, who founded a tram seating company in 1974. This entity gradually evolved into a supplier for the automotive industry. In 1997, Peugeot Group acquired Bertrand's stakes and progressively increased its controlling interest to over 70% by 2001.

By 2021, following the merger of Peugeot and FCA (Fiat Chrysler) to form Stellantis, the resulting group began divesting its control over Faurecia, ultimately reaching a free float of 95%.

In 2022, as a result of its acquisition of Hella, the company was rebranded as Forvia. The majority shareholder subsequently became the Hella family (9%), through payment in shares, with both the Peugeot family (3.1%) and the Agnelli family (5%) (Stellantis, Ferrari, Juventus, etc.) retaining their shareholdings from Stellantis divesting.

Forvia is currently a critical global supplier in the light vehicle industry. As a provider of complete modules or components, Forvia operates as a Tier 1 supplier within the industry. Tier 1 suppliers are distinguished from other vendors by their direct provision of complete components to Original Equipment Manufacturers (OEMs).

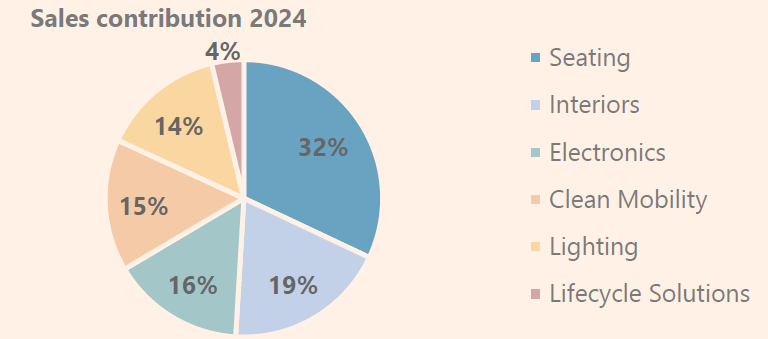

Specifically, Forvia supplies seating systems, instrument panels, interiors, emission reduction systems, lighting, and various electronic sensors.

The sales distribution by segment for 2024 is as follows:

We've briefly introduced the company; now let's continue discovering it by examining the market's reasons for penalizing it more than the rest of the sector, and the 'buts' we can add to Mr. Market's pessimism.

📰Market narrative

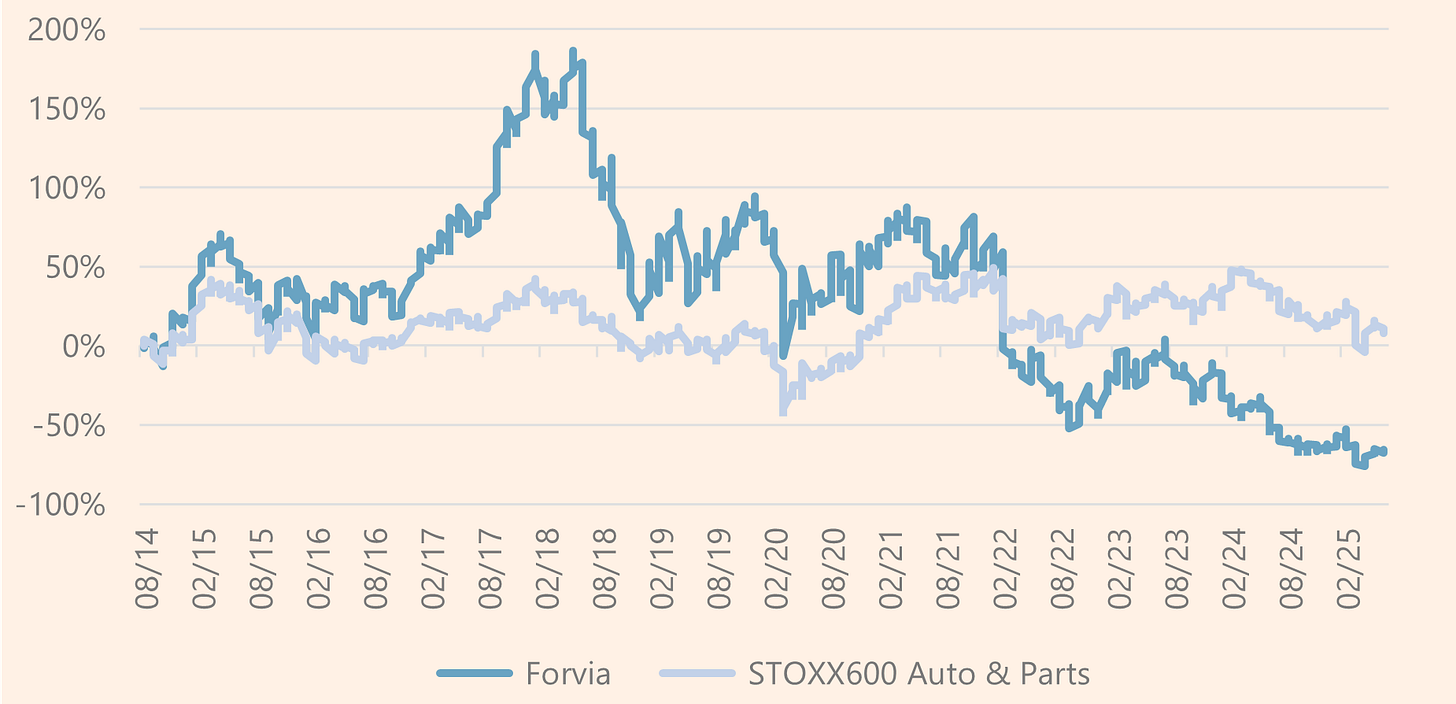

Forvia is one of the most penalized European automotive parts manufacturers, with a 64% decline over the last 3 years. Beyond the inherent cyclicality of the automotive sector, three reasons intensify the pessimism surrounding Forvia.

1️⃣Automotive is a struggling sector where the viability of clients such as Stellantis, Volkswagen, Ford, Mercedes (45% of 2024 sales) is in doubt due to electrification and Chinese competition. And Forvia owes most of its revenue to these customers.

2️⃣14% of revenue comes from the Clean Mobility division, a leader in ultra-low emission (ULE) systems for both light and commercial internal combustion vehicles. It is the only division that has not grown since 2016, with an annualized decline of around 1% per year. Furthermore, this division contributes 25% of operating profit in 2024.

3️⃣Additionally, Forvia acquired Clarion Electronics in 2019 and Hella in 2022, increasing its debt-to-EBITDA ratio to over 2x. Among its main competitors, it represents the highest ratio. The debt risk is causing greater price volatility during tariff turbulences, where Forvia would be highly impacted in less favorable scenarios.

In summary, Mr. Market has three good reasons to be pessimistic. Let's analyze them in detail and see if is overreacting.

🤔Yes, but..

📍Positioning

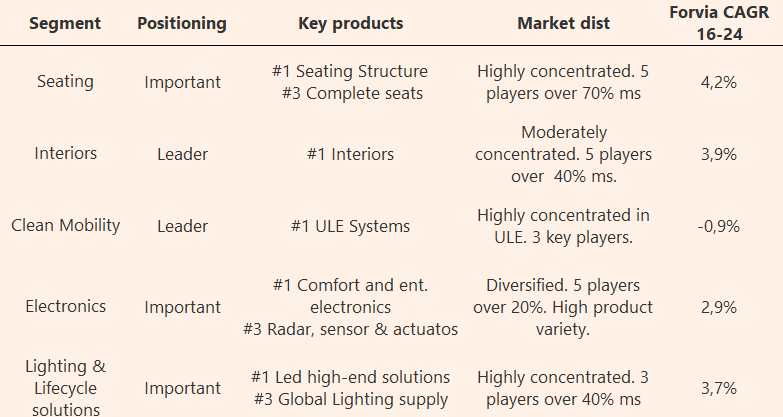

Forvia is a global leader or key player in all its segments, within an industry that has been consolidating in recent years. We extensively discussed the capital cycle in autoparts in the Dowlais thesis. I've provided a link if you wish to gain further insight into this matter:

In a brief summary: the sector is experiencing a phase of low profitability that incentivizes companies to restructure and merge. These are also periods where assets depreciate above the reinvestment level. In other words, productive capacity is destroyed and the remaining is divided among fewer players. When volumes return to the sector, margins soar due to lower available supply and increased bargaining power.

As we can see in the graph, the margins of Forvia's top 10 competitors* were over those of its customers until the onset of the pandemic and the war in Ukraine. OEMs have been more capable of passing on cost increases to their customers.

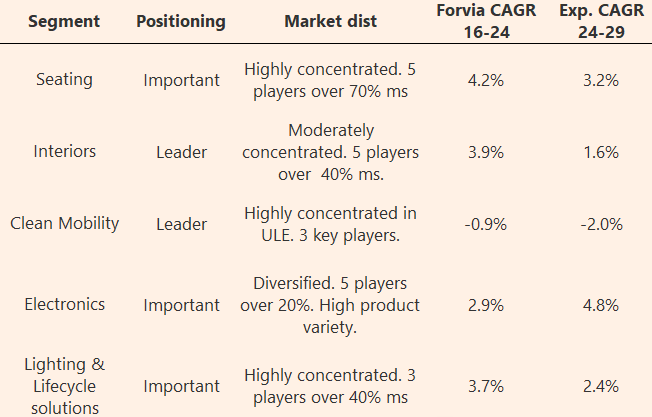

This table summarizes the positioning by segment and the concentration level of each market:

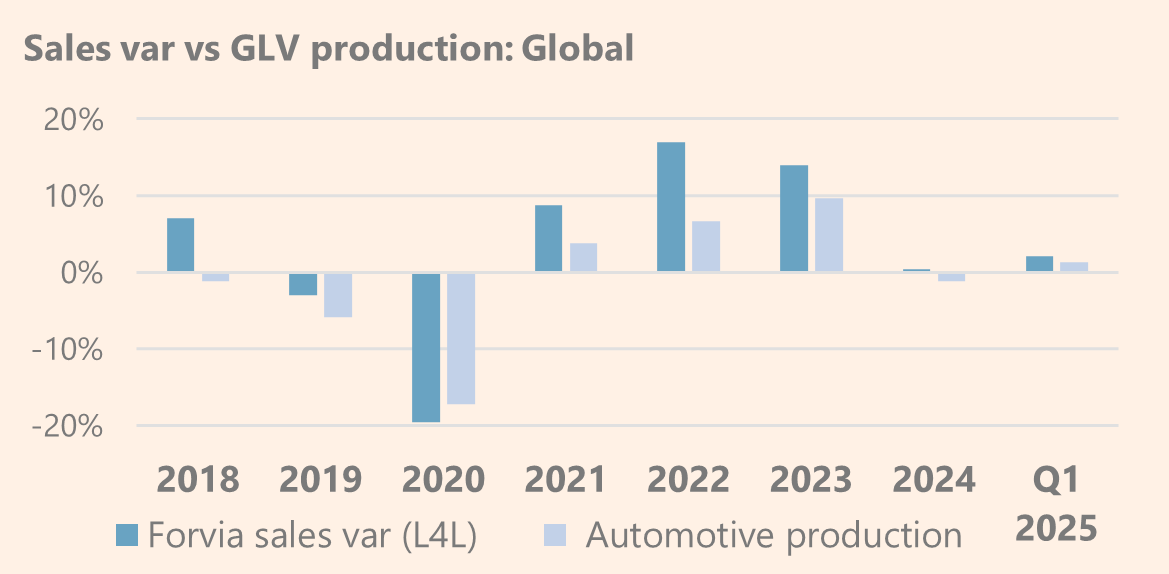

The annualized growths (CAGR) shown in the table (like-for-like sales) have outpaced global light vehicle production growth since 2018, demonstrating the group's strength.

This is true not only in its traditional markets, like Europe, but also in Asia, a market that already accounts for over 25% of sales. Furthermore, as a key supplier to new Chinese OEMs (BYD, Chery...), it is participating in the initial steps of these new brands' manufacturing in Europe.

BYD, in its expansion into European manufacturing territory (Hungary and Turkey), has an agreement with Forvia for component supply. In Thailand, the roles are reversed, where Forvia has set up an assembly plant with BYD as a partner.

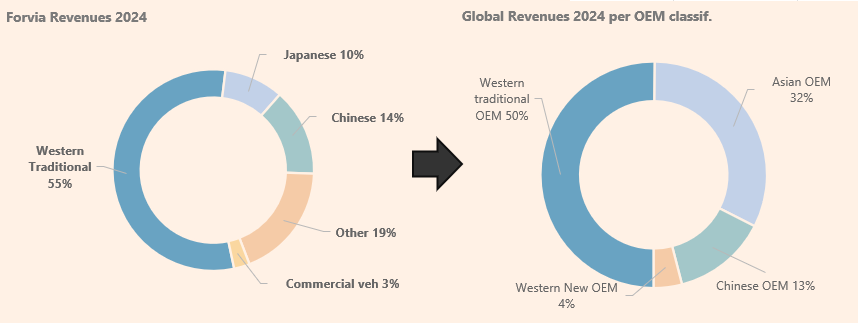

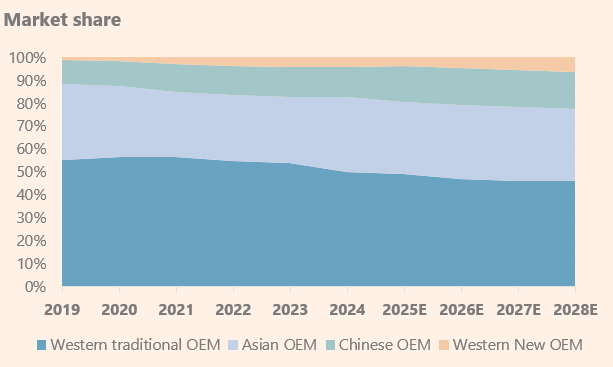

These arguments should diminish Mr. Market 1️⃣ concern regarding Forvia's dependence on traditional OEMs, but we will reinforce them with a comparison of 32 of the world's main OEMs, classified by region. This includes 8 Western traditional OEM, 8 Asian, 13 Chinese , and 3 New Western OEM (like Tesla).

As we can see, Forvia's dependence come from its role as a global supplier to the industry, and today, the world's leading manufacturers by revenue remain its traditional clients. The weight of potential Chinese game-changers in the revenue of the 32 analyzed companies is very similar to their weight in Forvia.

The annualized growth expected by analysts until 2028 is 10% for Chinese OEMs, 4% for Asian OEMs ex-China, and 2.6% for traditional OEMs. This leads us to a 2028 where traditional OEMs still account for around 45% of the market share. In my opinion, Forvia will be there.

Moving on to addressing Mr. Market's concern 2️⃣, we're not only going to discuss why the Clean Mobility division might have more runway than the market is anticipating, but also the potential of the rest of the portfolio.

💼Portfolio

Forvia has a portfolio highly neutral to electrification in the case of Seating or Interiors, and other favored segments like Electronics or Lighting. Let's analyze the trends that could guide these markets.

Seating: The importance of interior comfort could increase the CPV (Cost Per Vehicle) allocated to seats in dynamics such as autonomous driving, although it would remain below products like electronics.

Interiors: Trends such as autonomous driving will increase the importance given to the vehicle's interior. Lower technological barriers and higher competition make this segment weaker in terms of margins, although Forvia's competitive position and joint offering, combined with a restructuring plan, could sustain the segment's growth.

Electronics: Electrification and technologies such as autonomous driving or parking assistance will increasingly boost the need for sensors and radars. Autonomous driving increases the demand for entertainment and comfort electronic solutions.

Lighting: In a highly concentrated market, Forvia plays a key role. LED systems, electronic lighting management, interior lighting... headlights are no longer just a replaceable structure with a bulb. In some cases, exterior lighting, both main and auxiliary, forms part of the character of new EV models.

So far, we have covered the neutral-to-benefited part of the portfolio. Now let's look at Clean Mobility, a segment very negatively impacted by electrification.

Clean Mobility: Segment primarily dedicated to emission reduction systems for ICE vehicles which seems destined for a zero terminal value, could be a significant cash generator due to two trends:

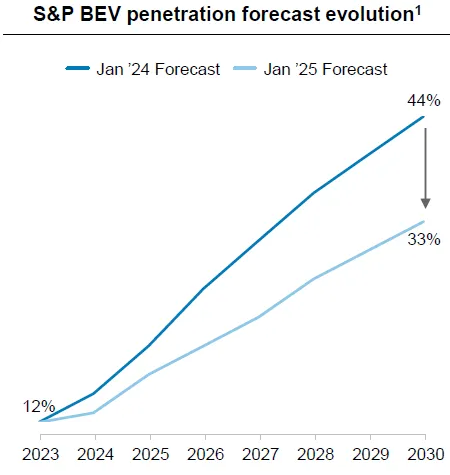

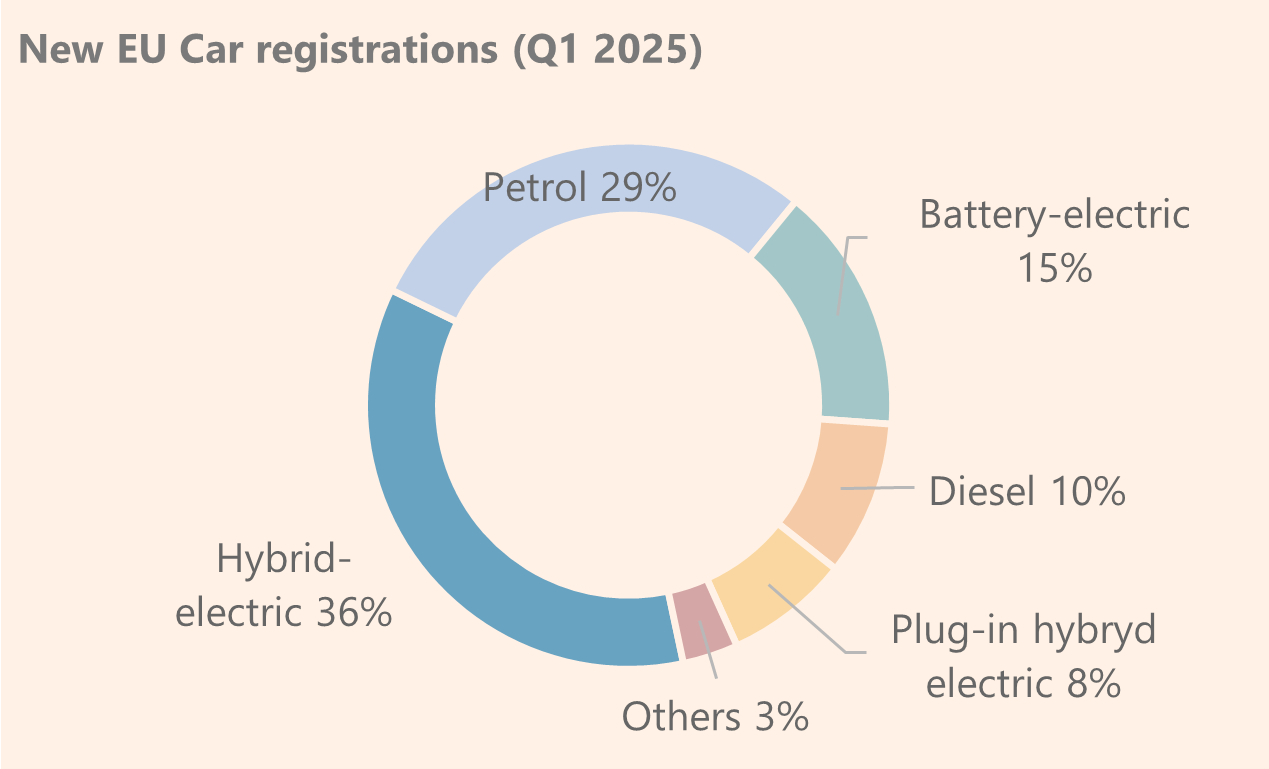

Delayed penetration of BEV: Since 2019, the penetration forecast of the total number of vehicles has been falling steadily. The latest revision puts it at 33% and government plans have been relaxed.

This dynamic is clearly seen in the European Union, where consumers are opting for hybrid technologies, with diesel and gasoline still accounting for 38% of new vehicles.

Fuel Cell Electric Vehicles: Forvia owns 33% of Symbio, a joint venture with Michelin and Stellantis focused on dominating the hydrogen fuel cell market for commercial and industrial vehicles. They currently have a manufacturing capacity of 16,000 fuel cell systems with an expectation to reach 100,000 by 2028. This company could replace the ULE portfolio share in commercial vehicles (trucks & buses)

As we can see, the life of ULE (Ultra-Low Emission) systems doesn't end with gasoline or diesel vehicles, nor will their demise be as soon as expected. Furthermore, 85% of the group's revenue comes from divisions with favorable electrification trends.

Let's address the last of the market's three concerns about the company.

🫰Solvency

Mr. Market's concern 3️⃣ is exacerbated by 1️⃣and 2️⃣. If market expectations for an industry, or for the company itself, are negative, debt appears more difficult to manage. Having addressed the first two concerns, let's see if the debt can truly be that problematic.

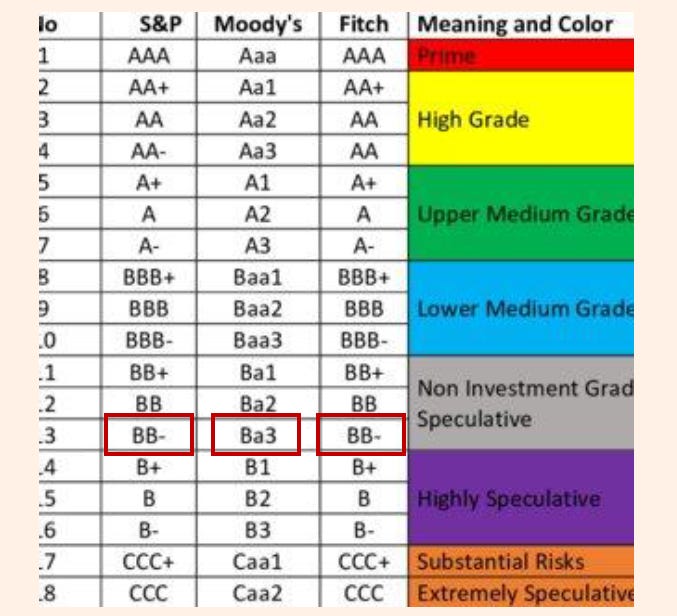

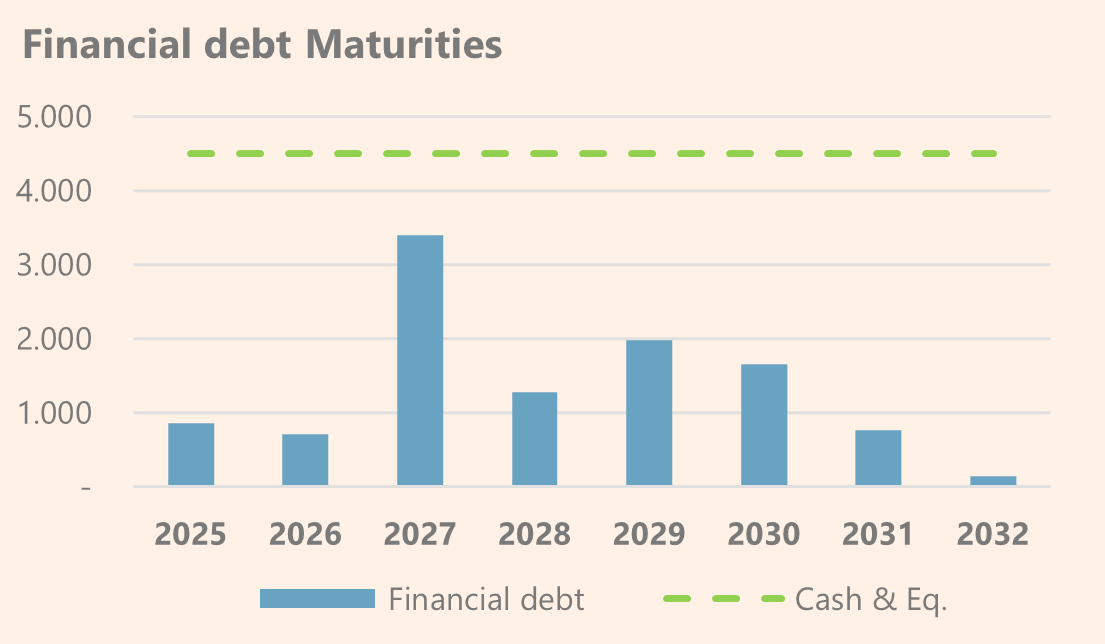

The group's financial debt is currently rated as high yield by the main rating agencies. These ratings were issued prior to a round of refinancings that occurred in the first quarter of 2025. It is true that bonds amortized at 3% have been replaced by bonds at 5.6%, but this only has an impact on the average financial cost of 46 basis points, raising the average cost to 3.86%.

Despite the high debt ratio, Forvia has no significant maturities until 2027 and has been consistently reducing its debt since 2022. Concurrently, it is implementing an aggressive restructuring program, reducing 2900 employees in 2024 and an additional 2700 in 2025 (4% of workforce) related to its EU-FORWARD program. The expected annual savings from the program are up to 500 million euros starting from 2026.

After addressing the company's three main medium-term concerns, I believe we can now say it: this is not the end. Now our task is to check if there's margin of safety at current prices.

📊The numbers

Forvia is currently trading around €8 per share, at 2008 financial crisis lows. In the previous cycle between 2009 and 2019, the company appreciated by a stunning 1000%. Yes, you read that right. Forvia's stock, then Faurecia, comfortably exceeded €60 per share. We're not going to be that optimistic, but there could be value here. Let's look at a 4-year scenario to see what Forvia's sales and margins could be, based on our analysis.

2029 scenario

It's true that the global annual vehicle production level remains below 2019, mainly due to the real estate and financial crisis in China. The tariff chaos has delayed the recovery to pre-pandemic levels until virtually 2029, but sustained growth is generally expected with a 1.1% annually until 2030.

Since 2017, Forvia has historically grown at rates above global vehicle production (like-for-like). While global production fell by 1% annualized between '17 and '24, Forvia grew at rates of 2.8%.

Adding the boost from the higher-growth Hella legacy divisions, we project an annualized growth of 2.3% until 2029, driven by both volume improvement and pricing, in a sector that has experienced significant industry consolidation. Adding the restructuring, will boost margins. The projected sales scenario by division is as follows:

As we mentioned earlier, Forvia is carrying out an ambitious restructuring program with which it expects to achieve annual savings of €500 million. These programs are aimed at resizing its production capacity in Europe. Being conservative, we project reaching €300 million in savings by 2029.

This scenario leads to 30 billion in Revenue and an EBIT of 1.7 billion, close to 6% of sales.

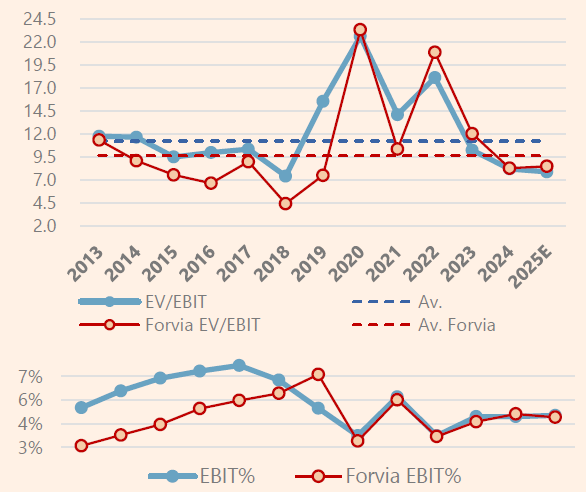

We are going to value the company using EV/EBIT because this multiple allows for the unification of criteria between companies (some competitors and Forvia capitalize R&D as an asset) and the analysis of previous cycles.

🧮Valuation

Our projected 2029 scenario anticipates a phase of increasing margins, consistent with sales growth. This period is expected to coincide with a notable market disinterest in the sector, much like the recovery in auto sector fundamentals seen in 2015-2016.

At that time, despite the improvement in fundamentals, the sector was trading at an average of 9.5 times compared to Forvia's 7 times, which was lower than in previous years.

Forvia's business has gained in quality and expected growth with Hella, which justifies aligning it more closely with its competitors for this new auto cycle, as we can see in the margins and current multiples where Forvia trades currently near the average.

Let's take 7.5x EV/EBIT as a conservative pivotal value in our 2029 scenario and examine the valuation:

In the mid-case scenario, the target price more than doubles the current valuation, offering a margin of safety and attractiveness at current prices.

📜Conclusions

The market narrative predicts a difficult future for traditional OEMs due to the entry of new purely electric players. This has impacted in their suppliers, a concern amplified by the threat of tariff wars. The situation has hit Forvia particularly hard, given its debt, which positions it at a higher vulnerability if pessimistic scenarios materialize.

However, the market appears to be underestimating the level of integration that suppliers like Forvia have with new OEMs. As we've seen, these new players are relying on their established suppliers in China for their globalization efforts. While this narrative persists and macro-level vehicle production lags, a significant resizing of auto parts suppliers is underway through internal restructuring, disciplined Capex, and strategic M&A.

Forvia has been an active participant in this process, solidifying its position as a key player across several of its core markets, where the long-term dynamics of the automotive sector could prove favorable.

In a scenario of moderate auto cycle recovery, driven by growth in China and anticipated interest rate cuts in the EU and USA, incremental vehicle demand combined with fewer players in the sector will boost margins. This should mark the beginning of the cycle's upward phase, providing compelling investment opportunities.

Despite the uncertainties and the potential for a deeper low-cycle phase, Forvia offers attractive profitability with an IRR exceeding 20% at the proposed valuation.

As I mentioned in the introduction, Forvia's market valuation has a significant divergence from Hella's, which introduces a margin of safety element at current prices. We will dedicate the final section of today's thesis to extend the paradox with which we introduced the thesis.

But first, a quick goodbye to those brave enough to stick around till the end. If you enjoyed it, hit like button and subscribe!

😮A market paradox

Forvia owns 82% of Hella, a listed German company specializing in lighting and electronics for the automotive sector. Hella's sales represent 30% of the group.

However, Forvia's current market cap is €1.65 billion compared to Hella's €9.6 billion. It's easy to assume that Forvia's stake in Hella is worth €7.87 billion, which is more than Forvia's entire valuation. This is an incredible price divergence, although two observations must be made:

All of the group's debt is held by Forvia. Hella has no debt as an independent company.

Hella has a very low free float and trades at a high multiple, ~21 times LTM EV/EBIT.

Let's consider these factors. The first: Forvia's Enterprise Value, excluding Hella's assets and liabilities, is €8.838 billion. The second: let's lower the valuation to an EV/EBIT of 10 times, consistent with competitors. This gives us a valuation of Hella's stake (82% of the total) of €3.671 billion. If we adjust Forvia's EV to the valuation we've made of Hella as if it were a financial asset on the balance sheet, Forvia's EV would be €5.167 billion (€8.838 - €3.671). Forvia's net financial debt is €7.195 billion.

€5.167 billion - €7.195 billion... Forvia is trading below the value of its Hella stake. In other words, the market is projecting that Forvia's other businesses are a drag.

DISCLAIMER: All the information provided in this document is purely informative and does not constitute a buying recommendation (according to Spanish Law Article 63 of Law 24/1988, of July 28, on the Stock Market Regulator, and Article 5.1 of Royal Decree 217/2008, of February 15). DuckPond Value Research is not responsible for the use of this information. Before investing in a real account, it is necessary to have the appropriate training or delegate the task to a duly authorized professional.

Reach us on duckpond@duckpondvr.com

Thnks. Great work.

Besides Forvia´s restructuring, the thesis is a demand narrative for the period 2024/29. Adding volumes to a stable fixed cost structure that will leverage operating margins.

Just I do not see this sales growth happening. And operating leverage is a double edge sword.

Do you see further sector consolidation among Tier1s ?

Forvia is a highly interesting stock, currently deeply in the penalty box. If the auto market recovers, it is totally possible for Forvia to print an EPS of ~5€. At a 7x EPS multiple, the upside is dramatic, while at the same time the downside seems to be limited...