the Pond Journal #1

AI Bubble, Gold Haven, Beyond Meat and Hidden Opportunities in an All-Time-High Market

Welcome to the Pond Journal, a bimonthly newsletter fromDuckPond Value Research. In this first issue, we’ll analyze the AI bubble, the haven of gold, and the investment opportunities that still exist in a seemingly overheated market.

A Market at Record Highs, a World in Transition

We live in strange times. Some say we are on the edge of a cycle change—geopolitical and social—provoked by globalism, fiat currency, or capitalism. Everyone can choose their favorite guilty.

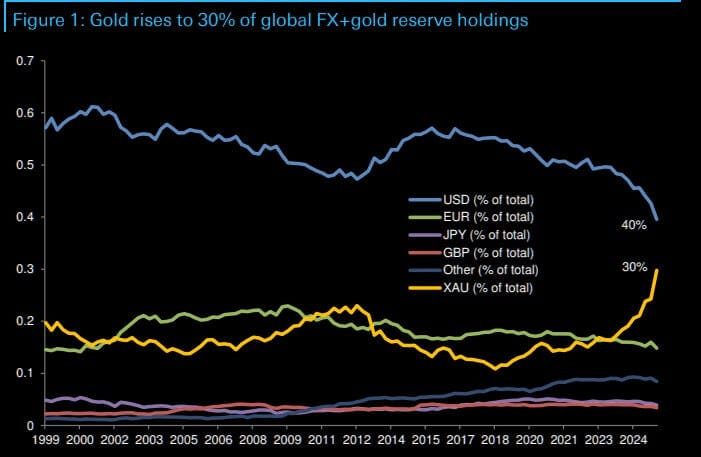

And on the eve of this “great moment”, liquidity continues to flood the markets, pushing indices to new highs while gold also reaches new historic highs, surpassing US Treasuries as the reserve asset of Central Banks.

While it’s undeniable that not every ‘all-time high’ (ATH) is a bubble, the current market situation shows several signs of being one. Let’s take a look.

Valuation highs

The current Price/Earnings (P/E) ratio of the S&P 500 is 31. Excluding the “Magnificent Seven” (Mag-7) which trade at 45-50 times, this leaves us a ratio of 20-21 times, or, put differently, an implied return of 5% with US debt yielding 3.5%. And one additional consideration: the index’s P/E is calculated based on the earnings of the last twelve months, where many companies have achieved peak profits.

The Shiller $P/E$ (CAPE ratio) measures how many times the market pays for the average inflation-adjusted earnings of the last decade, allowing the multiple to be normalized across the business cycle. The ratio stands at 40 times earnings, which has not reached the levels of the dot-com bubble but indicates clear overvaluation levels.

It is undeniable that AI is going to change the world, just as the internet did. It is also true that there is currently an AI bubble.

Bubble signals

A common element in all bubbles is that expectations inflate asset prices, and at the same time, these higher prices allow for the financing of investments that, in turn, reinflate expectations and prices. This is what we’ve recently seen with the purchase agreements between AMD and OpenAI, where OpenAI ends up as a partial owner of its supplier. The market rewarded the announcement with a 24% upside. Announcements, not tangible results. The interdependencies are multiplying, as we can see in the graph published by the WSJ.

(I recommend the masterful quarterly letter on this topic by Javier Ruiz, manager of the Horos Value Internacional fund (🔗) )

But the bubble isn’t just overstating the big names such AMD or NVIDIA. An entire chain of component suppliers, data center construction, industrial energy and cooling, and services to these companies is expanding its structure with investment and employment, all sheltered by expectations for cash flows that may not materialize—or at least not at the necessary rate.

In a powder keg like this, a single match is enough for everything to go up in smoke.

A clear example of this is the company AST SpaceMobile. The American company is setting up a low-Earth orbit satellite constellation that could revolutionize global telecommunications. The shares are currently trading at 150 times sales, and the company is not yet generating profits.

Let’s imagine that AST manages to grow its revenue at an impressive 20% annually for a decade and obtain seemingly unreal profit margins of 60%. At current prices, AST’s P/E ratio in Year 10 would still be 40 times earnings, 2.5% yield.

A week ago, it was trading with a market cap close to that of Kellogg’s—a company that generates USD 13 billion in sales (vs. USD 120 million for AST).

There are more signals. The appetite for risk is insatiable.

Appetite for Risk

Beyond Meat is a plant-based meat company that had great success in its 2019 IPO, supported by figures like Bill Gates and Leonardo DiCaprio. Expectations became so inflated that they were impossible to meet, causing the stock to drop from trading around $150 to the current $2.50. The company, operating since 2016, still has not generated profits and has even seen its sales stagnate. Furthermore, it is highly leveraged.

Merely an announcement of distribution plans in Walmart stores and the appetite for risk were enough for the market to turn it into a meme stock, inciting thousands of investors to execute a short-squeeze (forcing short sellers to buy, by buying massively, which in turn causes a further increase in price). Shares rose by 1,100% to $7.6 in 2 days, only to fall by more than 50% afterward, with daily volumes 1,000 times higher than usual.

Compared to this craziness, gold’s all-time high makes much more sense.

Not All-Time Highs Are a Bubble

High public debt, combined with the inability or disinterest of politicians to adjust the deficit, creates expectations of further fiat currency degradation. At the same time, Central Banks are buying gold to back their currencies against this degradation and the new geopolitical game.

Gold is at an all-time high against our beloved fiat currencies, but not against real assets like housing or other commodities. There is no bubble here, only a paradigm shift.

There’s always value somewhere

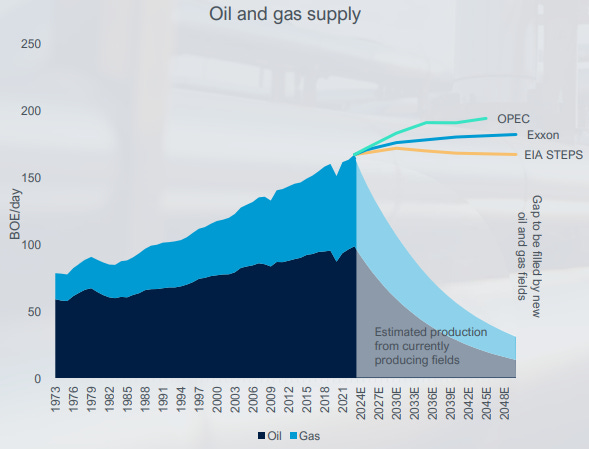

Despite being in a market at all-time highs, there’s always hidden value. For instance, look at the oil cycle: The Brent barrel is currently near $60, and once again, it seems like the end of crude oil.

It is true that growth in crude demand has slowed, but it will still account for 30% of energy production in 2050, with India and other emerging countries maintaining or driving demand. Estimates from the International Energy Agency (IEA) project demand growth of 0.4% annually until 2030.

But the biggest imbalance may not occur on the demand side, but on the supply side. The expectation of lower demand has led to chronic underinvestment in new fields while existing ones are depleting.

The lack of investment will cause a decrease in supply and an imbalance with demand, boosting prices. Prices will spur exploration, and companies like TGS ASA (TGS), dedicated to sea-floor mapping, or drilling companies like Foraco International SA (FAR) will experience increases in demand. This is the capital cycle, over and over again.

But opportunities aren’t only in oil; here’s the link to the last two theses I’ve published.

And now I pass the question to you: Are there other sectors or geographies where you are currently finding opportunities?

Thanks for reading the Pond Journal. If you enjoyed it, don’t forget to subscribe and share your thoughts in the comments.

DISCLAIMER: All the information provided in this document is purely informative and does not constitute a buying recommendation (according to Spanish Law Article 63 of Law 24/1988, of July 28, on the Stock Market Regulator, and Article 5.1 of Royal Decree 217/2008, of February 15). DuckPond Value Research is not responsible for the use of this information. Before investing in a real account, it is necessary to have the appropriate training or delegate the task to a duly authorized professional.

Reach us on duckpond@duckpondvr.com

Your analysis of Beyond Meat as a case study of speculative excess is spot on. The company is a perfect example of how market sentiment can become completly detached from fundamentals - a business that still hasn't achieved profitability after nearly a decade getting treated as a meme stock shows just how much risk appetite is driving prices. The contrast you draw with gold's all-time highs is instructive; one represents genuine paradigm shifts in global monetary systems, while the other represents retail traders chasing momentum without regard for underlying value.