Welcome to the Pond Journal, a bimonthly newsletter fromDuckPond Value Research. In this second issue, we’re taking a 5-minute look at the capital cycle through two opposing stories: the intense supply squeeze in the airline industry and the painful cyclical trough for machinery makers like Biesse.

We are in earnings season, and although a single quarter does not determine a long-term investment thesis, the market is currently looking for reasons to either panic or “keep the party going” after every earnings call. As we discussed in the last issue, there are reasons to believe there is an AI bubble, but when and how it will burst remains unknown.

Right now, CNN’s Fear & Greed Index places us in “Extreme Fear.” It is time (as it always is) to review our convictions and ask ourselves which assets we would be willing to hold for 5 years while accepting big drawdowns.

I’ll just drop an idea in the following chart here, and if there is interest, we will expand on it in the next issue.

Getting back to earnings, from our ecosystem, Dowlais (LSE:DWL)—whose merger with American Axle (NYSE:AXL) is imminent—will report this week. Next week, we have results from Bayer (XETRA:BAYN) and Wizz Air (LSE:WIZZ), so we will likely dedicate a section to these matters in the next issue.

Biesse (BIT:BSS), the company that is the focus of today’s first section, reported last week.

Biesse: A falling knife?

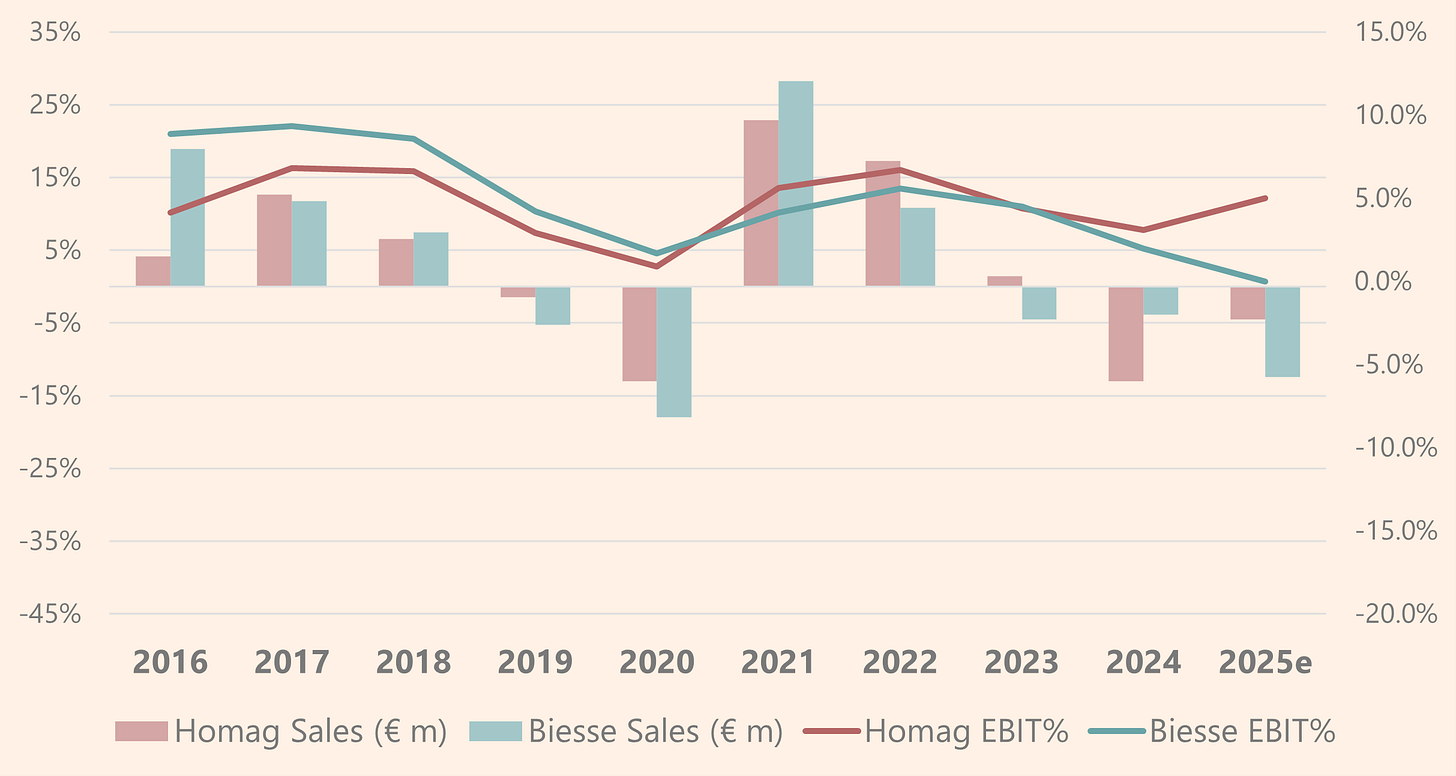

In October 2024, I published a full thesis on Biesse SpA (🔗), an Italian small-cap and a global leader in high-tech machinery for processing wood, glass, and stone. Despite the potential, I saw wait-and-see strategy was the best approach. This is due to the anticipated decline in sales in 2025 and significant uncertainties.

The scenario has played out, perhaps slightly worse than expected, and the stock plummeted 20% last week, caused by weaker Q3 order intake and resulting in a setback to ‘April tariff’ levels. Sales started to show signs of bottoming, down -3% in Q3, bringing the 9M (nine-month) total to -14%. The CFO mentioned, for the first time, a “reversal of the trend in order intake” and “First signs of reversal in Q4.”

The situation this year has been turbulent, with the departure of the CEO in 2024 and the CFO in recent months. The new CEO is Roberto Selci, son of the founder and the largest shareholder through the family holding company.

It is true that the overcapacity in the wood industry is also being seen among its competitors, such as Homag (Durr Group), although Biesse has been particularly hard-hit this past year.

This situation could represent an opportunity; after all, this family-owned company has navigated worse cycles, and furthermore, it does so with a solid net cash position (debt-free). I will soon publish an update where I will focus on analyzing Biesse’s demand drivers, primarily capital expenditure spending in the furniture industry.

And we move from a capital goods industry suffering from overcapacity, whose customers are not investing, to another where a duopoly is overwhelmed with orders.

Capital Cycle: The Airlines Squeeze

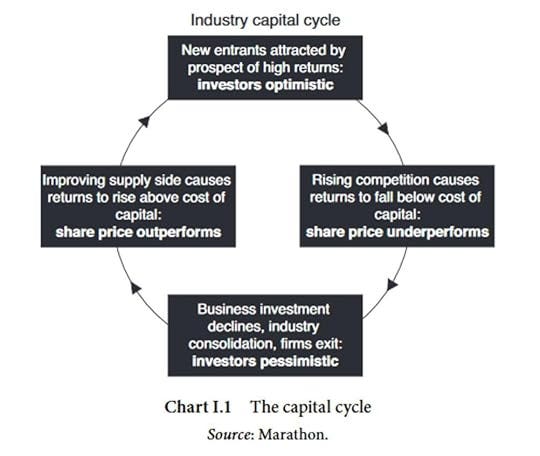

In issue #1, we discussed oil and the imbalance that arises when producers underinvest while demand remains stable or increases. But this dynamic is not unique to oil; it presents significant opportunities across sectors.

In this issue, we will discuss this dynamic as it also unfolds in the airline industry. I covered this in the investment thesis on WizzAir (🔗), which I invite you to read, but I want to summarize and expand upon those comments here.

Supply squeeze

✈️Manufacturer Delays: Airbus and Boeing have an order backlog of over 17,000 aircraft, equivalent to 14 years of deliveries. This is creating an acute shortage of new aircraft in the short to medium term.

♻️ Accelerated Fleet Retirements: The aircraft retirement rate is set to increase from 2-3% to 4% annually by 2043, driven by aging aircraft and environmental targets, further reducing available capacity.

Relentless Demand

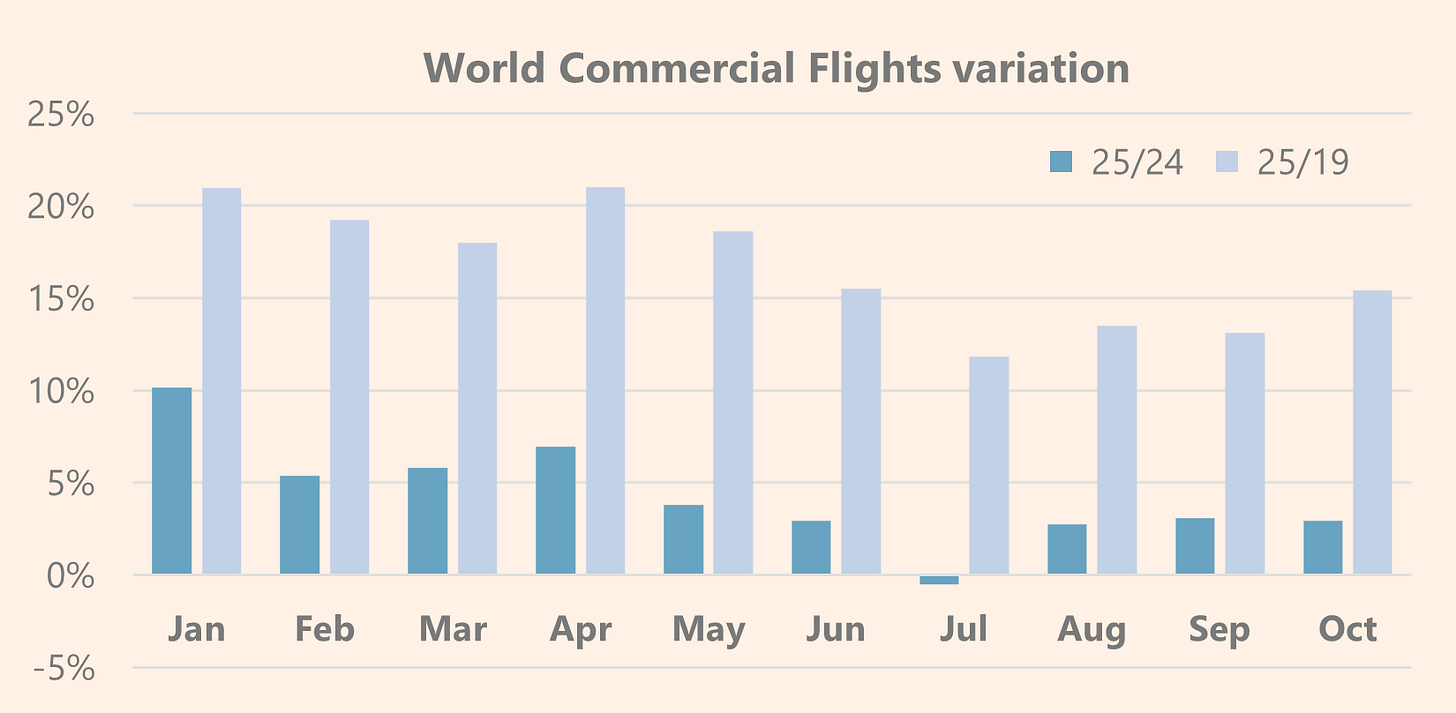

📈 Demand: Global demand remains very strong. Global commercial flight volume is already 16% YTD above 2019 levels and 4% above 2024 YTD. Remember, in 2020, some certified the death of aviation, just as they did in 2001.

In Europe, Ryanair reported results in November showing a load factor of 95%, consistent with the 95% from the previous year, and a 3% increase in passengers for the first half of its fiscal year (H1 FY, April-October). In the same period, Wizz Air reported a load factor of 92.5% (vs. 92.5% prior year) with a 10% increase in passengers. New fleet additions are being absorbed.

The Outlook: IATA projects passenger demand will continue growing by 8% while capacity grows by only 7%, reinforcing the pressure from limited supply in an expanding market.

Thanks for reading the Pond Journal. If you enjoyed it, don’t forget to subscribe and share your thoughts in the comments.

DISCLAIMER: All the information provided in this document is purely informative and does not constitute a buying recommendation (according to Spanish Law Article 63 of Law 24/1988, of July 28, on the Stock Market Regulator, and Article 5.1 of Royal Decree 217/2008, of February 15). DuckPond Value Research is not responsible for the use of this information. Before investing in a real account, it is necessary to have the appropriate training or delegate the task to a duly authorized professional.

Reach us on duckpond@duckpondvr.com