the Pond Journal #4

"Drill, baby, drill⛏️" : The Second Derivative of the Gold & Copper Fever

Welcome to the Pond Journal, a bimonthly newsletter fromDuckPond Value Research. In this fourth issue, we will explore where to find value thinking on the value chain of gold and copper.

In the Pond Journal #1 we discussed gold through the lens of demand: fiscal deficits, central banks, and inflation expectations. But we didn’t talk about supply. So today, let’s talk about mining. And not just gold, but let’s take it step by step.

The Scarcity Reality

Gold is a remarkably scarce mineral in the Earth’s crust. Each year, slightly less than 2% of new supply is added to the total stock of mined gold .

Furthermore, existing mines are aging, and discoveries of large deposits are becoming increasingly rare. As a result, Major miners are acquiring Junior companies with projects already underway given the astronomical cost and risk of starting from zero.

Financing for new ventures in junior companies had been completely halted since 2022-23 due to the high cost of capital, and has only timidly begun to reactivate during the second half of 2025.

Add to this the fact that banks like JP Morgan and Goldman Sachs see gold above $5,000/oz. The supply and demand imbalances are very clear.

“The Future” is fueled by Copper

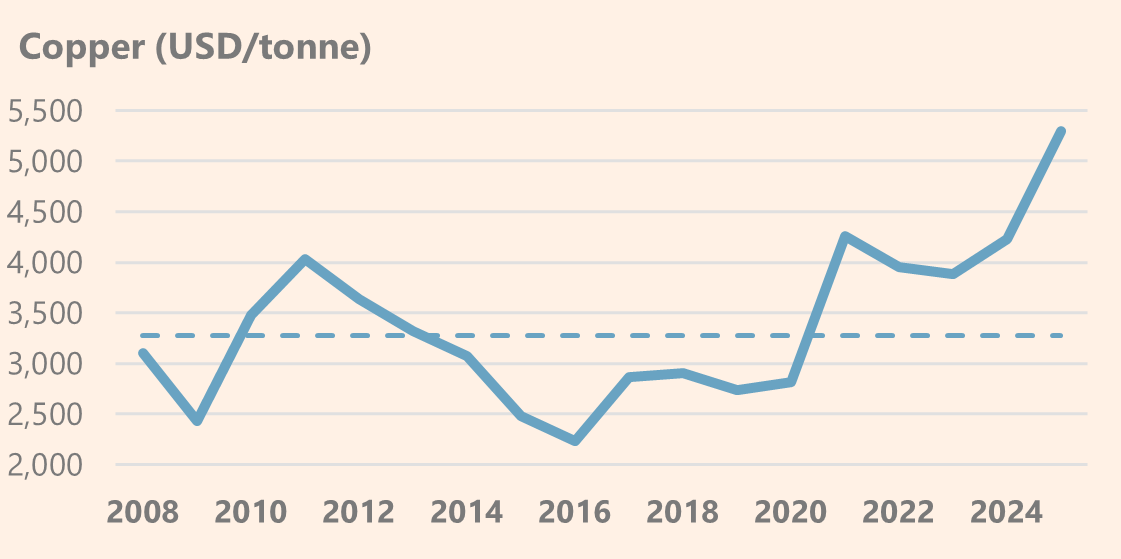

It’s not just gold. The demand for Copper, essential for electrifying the data centers powering AI, threatens to cause a structural supply deficit.

Mining giants warn that this “new gold,” vital for the green and digital transition, is running out. This physical reality clashes with the needs of tech “hyperscalers,” creating a deficit in a market where ore grades are falling (forcing miners to process more rock for the same output) .

Prices are screaming scarcity: up 114% in 10 years and 25% in the last year alone.

Here is a very important fact: Gold and copper together account for around 60-70% of the major mining companies’ exploration budget. And these could increase enormously.

Gentlemen, it’s time to increase the supply. And the first thing that must be done is to explore and drill holes: As Trump said, copying the previously coined slogan: ‘Drill, baby, drill ⛏️’

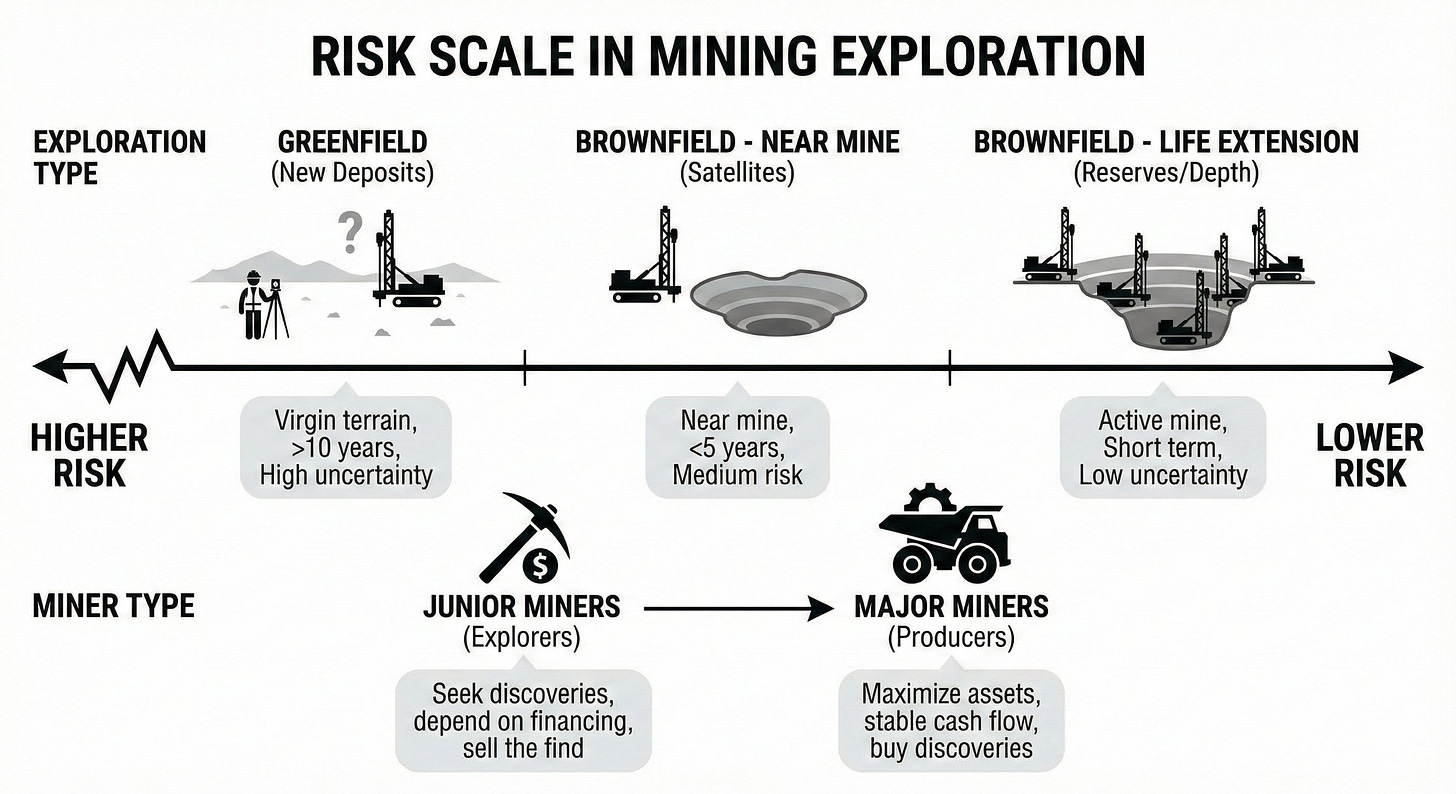

How far and how deep is a matter of price

Starting the exploitation of a mine from scratch is a long process, taking more than 10 years from the discovery of a new deposit. These projects are called ‘Greenfield.’ Geopolitical risk, costs, and the fluctuation of commodity prices make the profitability of these projects very difficult to determine, and they are only undertaken in phases of major imbalances between supply and demand.

Although we are approaching that moment, there is another way to increase supply. These are the so-called ‘Brownfield’ projects, which means taking advantage of operational deposits to explore around or at greater depths. These investments start up faster and are the first line of supply when mining companies begin to see clear imbalances in supply and demand.

Appetite for destruction? ⚒️

I have often referenced the concept that Edward Chancellor explains about the capital cycles in his book ‘Capital Returns’ in investment theses and articles. The importance of that book for investors cannot be overstated.

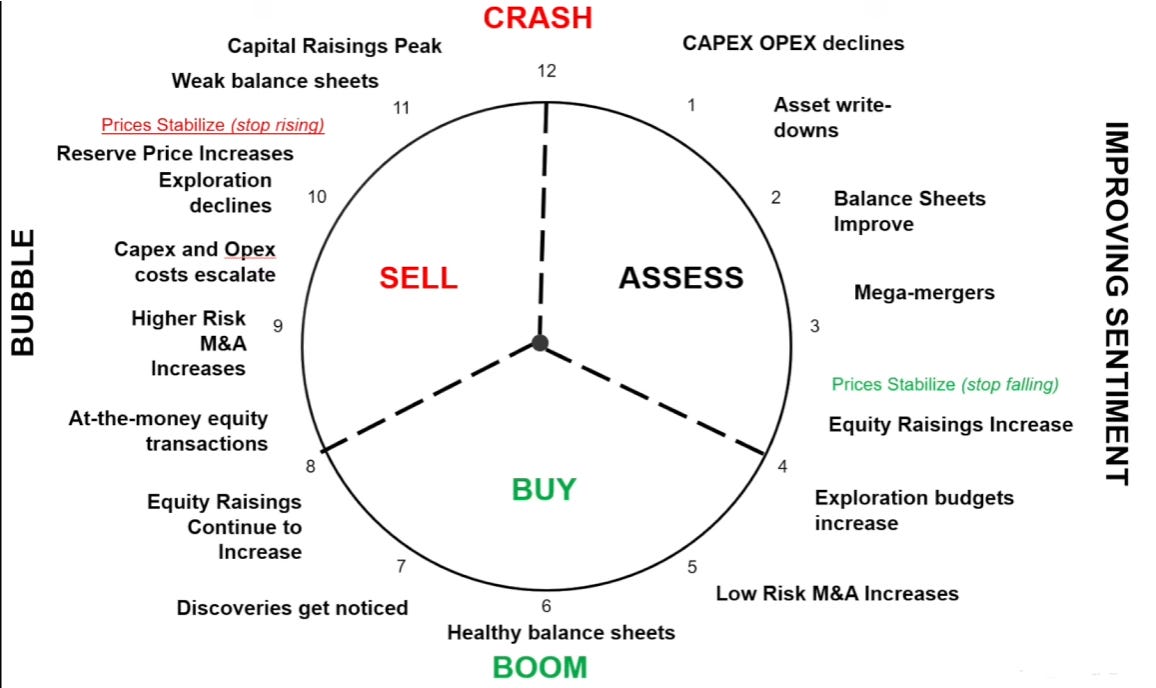

I am going to do it again today, but focusing on the special characteristic of the capital cycle in commodities: To do this, we are going to illustrate the cycle with the following clock, taken from the podcast by @Charlandodminas.

At 3 o’clock , the expected mega-mergers occurred: Barrick+Anglogold (2019), Agnico+Kirkland (2022), Newmont+Newcrest (2023) in gold, and BHP+OZ Minerals (2023) or Rio Tinto+Turquoise Hill (2022) in copper.

We don’t have a clock to tell us the exact time, but based on what we’ve seen so far, we must be somewhere between 4 and 6. Let’s look at the clues the market is giving us, illustrated with some charts:

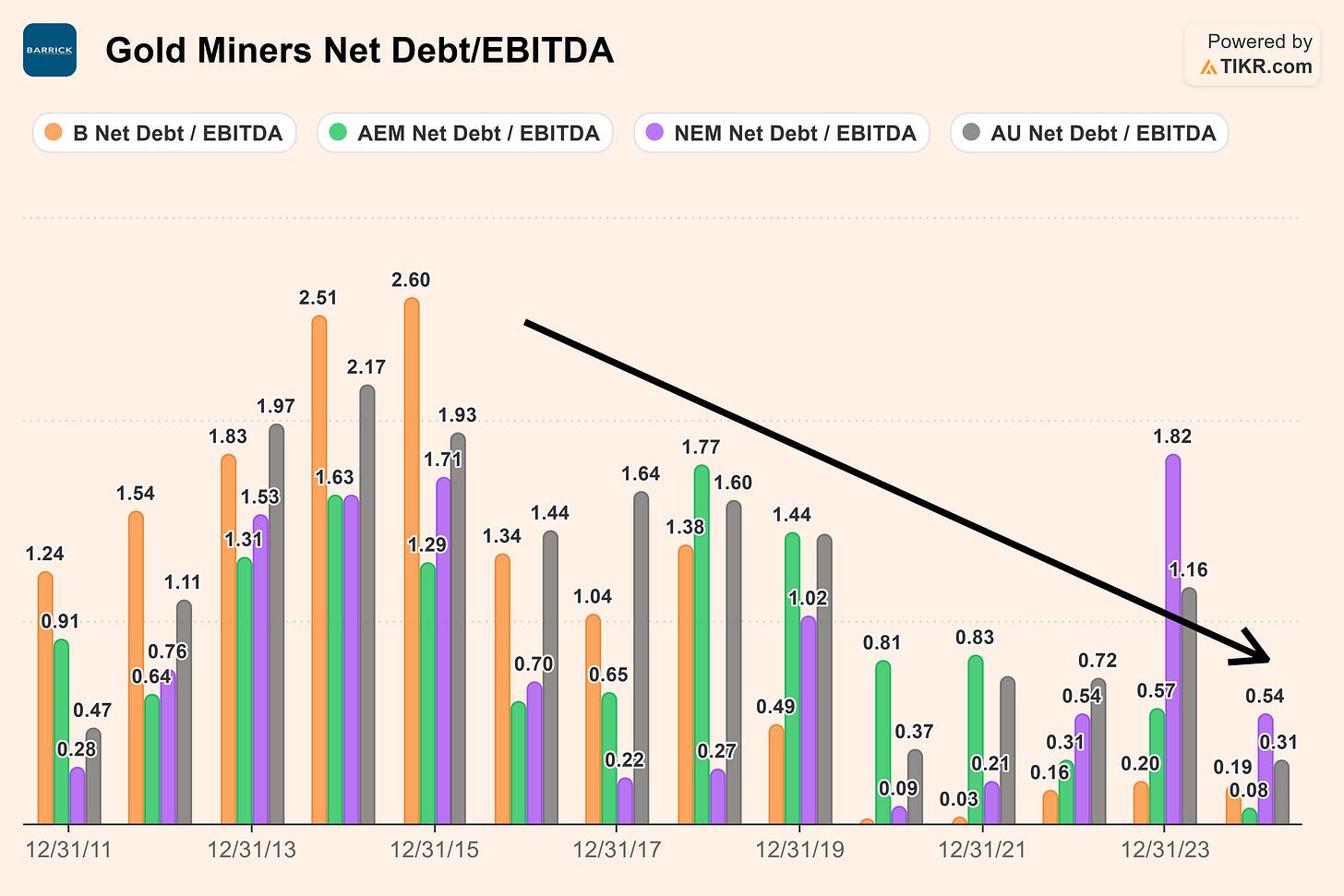

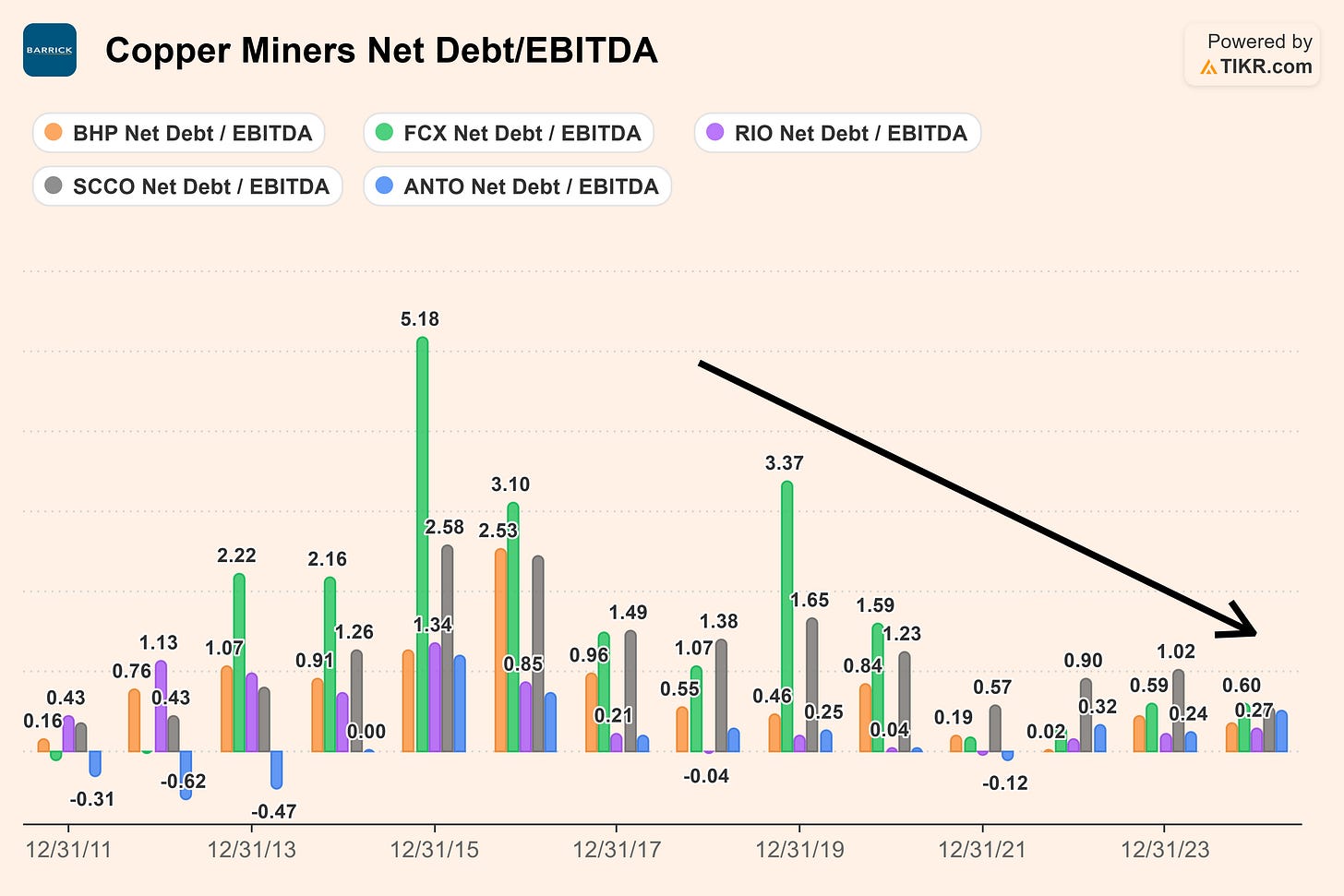

✅Healthy Balance Sheets: The debt ratios of mining companies, for both gold and copper, are historically low or very low. This allows them to consider investing in greenfield exploration.

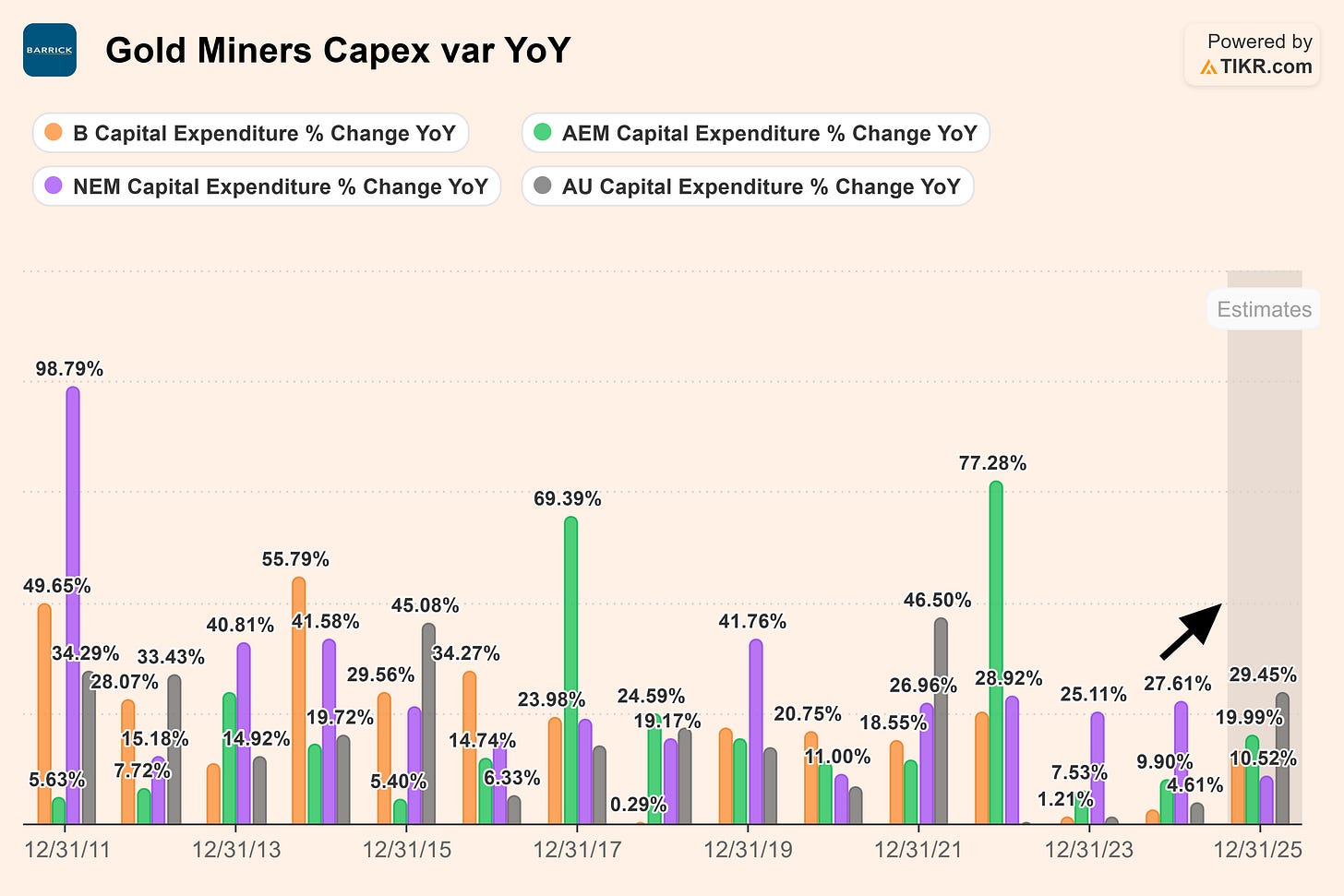

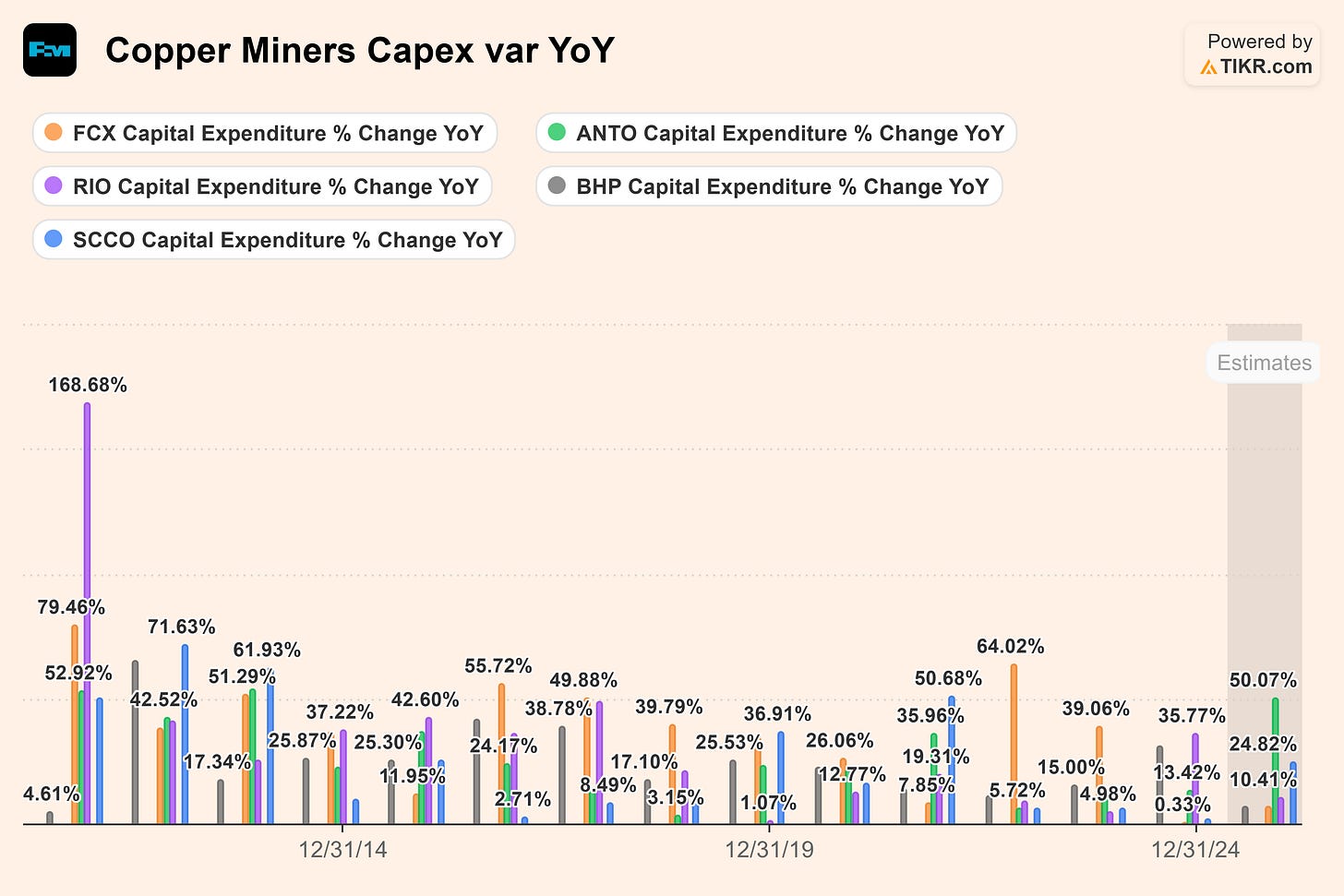

✅Exploration budgets: The years 2023 and 2024 were especially low, in general, and they are expected to increase in 2026. The instability in 2025 caused by tariffs has delayed this dynamic, but the geopolitical risks due to mineral dependency only exacerbate the need.

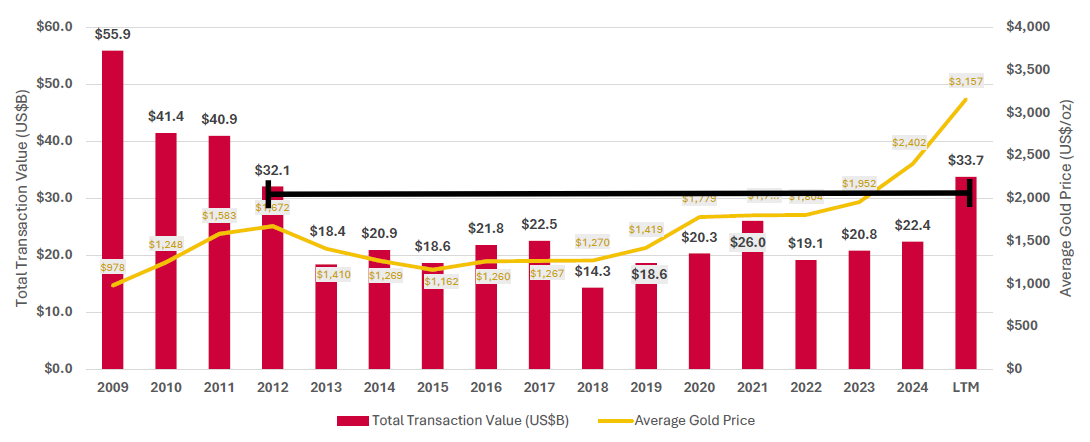

✅Equity Raisings & M&A: In the commodity cycle, at some point, prices begin to justify IPOs and capital increases for medium-risk projects. One measure of the start of the recovery of this appetite is seen in the financing of junior mining companies, which is timidly beginning to pick up in 2025, although without adjusting for inflation, it remains well below 2012 levels. Additionally, there are some examples of low-risk M&A between 2024 and 2025 in the sector.

We have enough evidence that appetite is awakening at a time when the sector has consolidated and is amply healthy (or financially sound).

Before the Supply… The Drillers

Long before the first ton of mineral is extracted from a new mine, even before the project’s feasibility is known, a vital supplier for mining companies comes into play: The Drilling companies.

These companies provide the specialized crews and rigs to extract the samples that confirm a project’s viability. It is a fragmented sector with few listed players. Crucially, their capital cycle reacts not just to commodity prices, but to their clients’ exploration appetite.

They are the “second derivative” of the boom.

And stay tuned, because I will be publishing a full thesis on one of these companies very soon.

Thanks for reading the Pond Journal🦆. If you enjoyed it, don’t forget to leave a like 👍subscribe🖊️ and share🔄 it.

DISCLAIMER: All the information provided in this document is purely informative and does not constitute a buying recommendation (according to Spanish Law Article 63 of Law 24/1988, of July 28, on the Stock Market Regulator, and Article 5.1 of Royal Decree 217/2008, of February 15). DuckPond Value Research is not responsible for the use of this information. Before investing in a real account, it is necessary to have the appropriate training or delegate the task to a duly authorized professional.

Reach us on duckpond@duckpondvr.com

Brilliant framing on drillers as the second derivativ of the boom. That timing lag between exploration appetite and actual mineral extraction is easy to overlook when everyone's chasing the majors. Ive been tracking how juniors financing dried up post-2022 and its wild how quickly sentiment shifted once rates came down. Looking forward to the full thesis, especailly around rig utilization metrics versus price elasticity.